Courtesy of Saudi Gazette

Jeddah – Companies across the Middle East and North Africa (MENA) are developing their business models and product offerings in a response to the changing trends in consumer preferences in the region, said in a recent report.

Companies are diversifying their product range, according to some reports. Take Almarai for example. The dairy supplier capitalised on consumers’ preferences for fresh products by expanding their offerings to include fresh poultry (over frozen alternatives) and juice. Other companies are on a similar path, said the report.

Not only food retailers are diversifying their product lines. Jarir Bookstore, which has outlets across the GCC, has adapted to the increasing demand for electronics, which now are sold in its stores.

The move toward adapting to consumer preferences by retailers comes as a response to the growth accelerating in up and coming product niches.

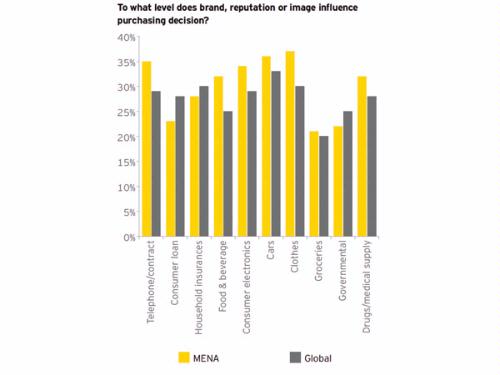

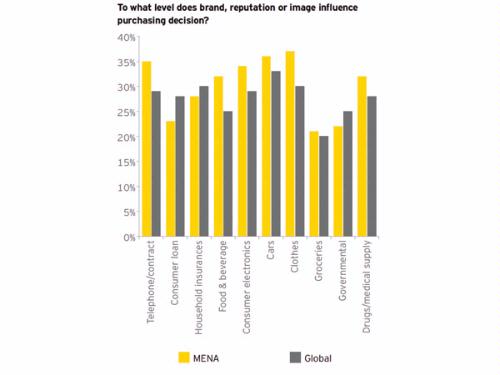

According to Ernst & Young’s 2012 MENA Customer Barometer, MENA consumers are among the most brand loyal consumers in the world. Twenty five percent of respondents in the UK and the US stated that brand influences their purchasing decision compared to 29 percent in Saudi Arabia, 31 percent in the UAE, 33 percent in Bahrain, 34 percent in Jordan and 35 percent in Oman.

The report also revealed that consumers are now harder to define, understand, and please than ever before and that MENA brands are facing challenges to adapt to “Chameleon Consumers”.

Five broad trends emerged from the survey, covering ten different products and services:

1. Traditional market segmentation no longer holds true. The ‘chameleon’ consumer has conflicting preferences and facets, which need to be accommodated.

2. Brands are increasingly likely to influence purchasing decisions within emerging markets, unlike the mature markets where lower loyalty is challenging companies.

3. Personalized communication and service is a priority. There are huge opportunities for organizations that can harness digital consumers through closer ‘community’ vehicles, such as social media and other digital channels.

4. Consumers are now equipped with all possible product, price and stock information and can simply bypass retailers that don’t engage consumers with relevant information and a compelling purchase pitch.

5. These new empowered customers want a greater say in how they experience service and to be active “co-creators”, not passive consumers.

The consumer base in the GCC region is growing at five million consumers per year. It indicated that spending is highest in the UAE at over 50 percent, followed by Saudi Arabia at 40 percent, and Qatar at 45 percent.

Moreover, retailers in the region are “moving away from disorganized neighborhood vendors toward organized retail outlets, such as hypermarkets,” the report mentioned.

For instance, organized retailers in Saudi Arabia are taking advantage of the country’s developed logistics infrastructure, high access to retail outlets by an increasingly mobile affluent population, the report mentioned. One example is Saudi Arabia’s Savola Group, which owns Panda Hypermarkets.

In the UAE, however, the scene is starting to look different.

Hypermarkets themselves have been expanding their reach via small neighborhood stores, according to a report by AT Kearney.

Lulu Hypermarket is planning to open 50 neighborhood stores across the GCC, while Carrefour is setting up its express stores across the UAE.

Ross Maclean, Customer Advisory Leader, Ernst & Young MENA, said: “The survey finds that in recent years, customer behavior has changed beyond recognition. In becoming a ‘chameleon’, the consumer has undergone a radical ‘metamorphosis’ and this change has significant consequences for all customer-centric organizations.”

The challenge of categorizing consumers is demonstrated by differences in consumer behavior between regions. — by SG/Agencies

More on: http://www.saudigazette.com.sa/index.cfm?method=home.regcon&contentid=20130123150249